- Market Overview

- Futures

- Options

- Custom Charts

- Spread Charts

- Market Heat Maps

- Historical Data

- Stocks

- Real-Time Markets

- Site Register

- Mobile Website

- Trading Calendar

- Futures 101

- Commodity Symbols

- Real-Time Quotes

- CME Resource Center

- Farmer's Almanac

- USDA Reports

This High-Yield Dividend Stock Is Getting a Makeover. Should You Buy Shares Here?

PepsiCo (PEP) made headlines on Tuesday when activist investor Elliott Investment Management disclosed a $4 billion stake, pushing shares up. The action indicates that the legendary beverage, snack icon, and long-term dividend darling can get back on track after lagging its peers in 2025 and the overall market. Elliott's argument is simple: Pepsi is one of the "rare" bets on revitalization that could have 50% upside if the company executes on a more ambitious plan.

This campaign arrives just as Pepsi fights to keep pace with North American sluggishness, shifting consumer preferences, and a valuation discount relative to peers like Coca-Cola (KO). Investors have a central question on their minds: Will Elliott’s initiative to transform operations and unlock value be successful in turning PepsiCo into a more efficiently growing behemoth?

About PEP Stock

PepsiCo is the largest consumer goods company globally, with operations in beverage, snack, and packaged foods businesses internationally. Pepsi, Frito-Lay, Quaker, and Gatorade brands of PepsiCo cover more than 200 countries around the world. With a market cap of around $201 billion, it is one of the largest consumer staples companies globally.

PEP shares have traded between $127.60 and $179.43 over the past 52 weeks, trailing the S&P 500 Index ($SPX) and archrival Coca-Cola. The stock has declined by around 2% year-to-date (YTD), compared with gains on the broader market, before Tuesday's surge bringing it back to the range of $147.

From a valuation standpoint, Pepsi is also trading at an 18.5 forward price-earnings ratio and a price-to-sales (P/S) ratio of 2.2. That's fairly lower than its five-year historical averages, given investor caution in the face of lukewarm conditions of U.S. demand. However, with a return on equity of nearly 58% and stable profitability, PepsiCo is financially robust.

Important here is the fact that the stock's dividend yield is around 3%, which is bolstered by $7.6 billion of scheduled shareholder distributions this year. Pepsi has increased its dividend for more than 50 straight years, so it is a staple of income-oriented portfolios.

Pepsi Beats on Earnings

Pepsi released second-quarter earnings that beat Wall Street predictions last month. Second-quarter sales of $22.7 billion beat estimates on the street, and EPS of $1.26 topped the $1.22 estimate as well. Net income came in at $1.26 billion, which rose modestly versus the prior year. International strength helped mitigate North American softness, particularly on the beverage unit side of the house.

Going forward, the management also reaffirmed the low-single-digit organic revenue growth in the 2025 fiscal year, with the core EPS arriving flat year-over-year at $8.16. Pepsi also stated that currency headwinds will decrease, lowering their estimated impact on earnings by 3% to 1.5%. With weak U.S. demand, Pepsi CEO Ramon Laguarta emphasized international market and portfolio innovation growth initiatives to regain U.S. momentum.

The company is also implementing cost-optimization efforts, closing plant operations, and streamlining logistics to improve margins. Elliott, by contrast, is pushing more drastic action, including potential refranchising of the company's bottle business and selling of underperforming assets. Overall, these efforts have the promise of making Pepsi a leaner, more margin-rich company.

What Do Analysts Foresee for PEP Stock?

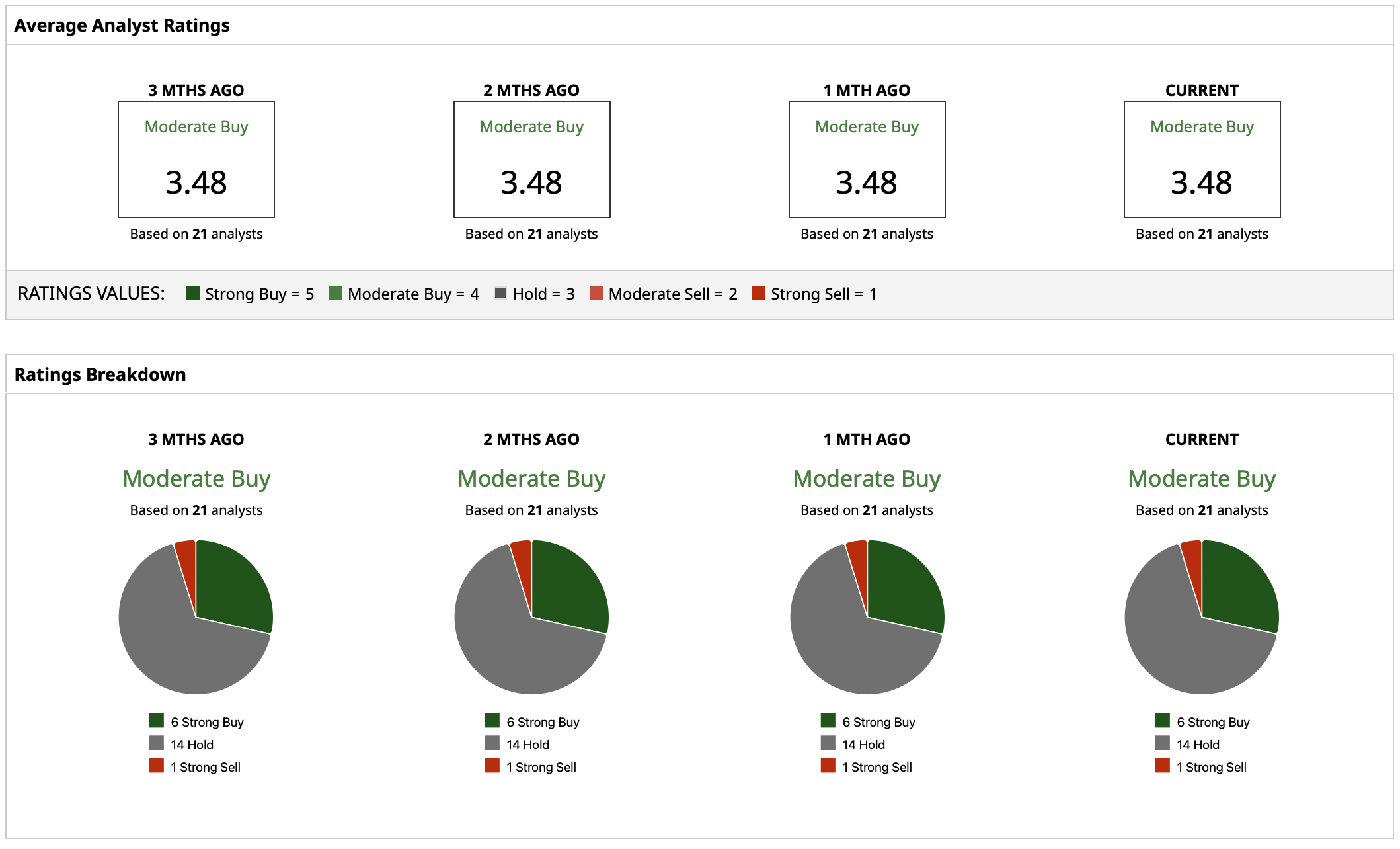

Wall Street's views of Pepsi are mixed. PEP stock has 21 analysts following it with a “Moderate Buy” rating consensus. The mean price target of the consensus is $153.61, which is an upside of approximately 4.5% on the current prices. The highest target of $169 indicates upside of nearly 15%, and the lowest of $115 has the risk of more than 20% downside.

While not as aggressive as Elliott’s 50% upside calls, the Street concedes Pepsi shares are undervalued relative to their long-term growth profile and cash return profile. With a secure dividend, global scale, and activist tailwinds, steady if not spectacular upside is ahead, say analysts.

On the date of publication, Yiannis Zourmpanos did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.