- Market Overview

- Futures

- Options

- Custom Charts

- Spread Charts

- Market Heat Maps

- Historical Data

- Stocks

- Real-Time Markets

- Site Register

- Mobile Website

- Trading Calendar

- Futures 101

- Commodity Symbols

- Real-Time Quotes

- CME Resource Center

- Farmer's Almanac

- USDA Reports

Weekly vs. Monthly Options: Why Staggering Expirations Over 4 Weeks Creates an Edge

The Bull Strangle Newsletter, released weekly, shares a trading strategy that has achieved a documented 76%-win rate and outperformed the S&P 500 by 240% since inception. The strategy combines buying stock and simultaneously selling out-of-the-money covered calls and cash-secured puts to generate option premiums and manage risk.

Introduction

This article covers 1 of 6 “risk rules” covered in the Bull Strangle Newsletter.

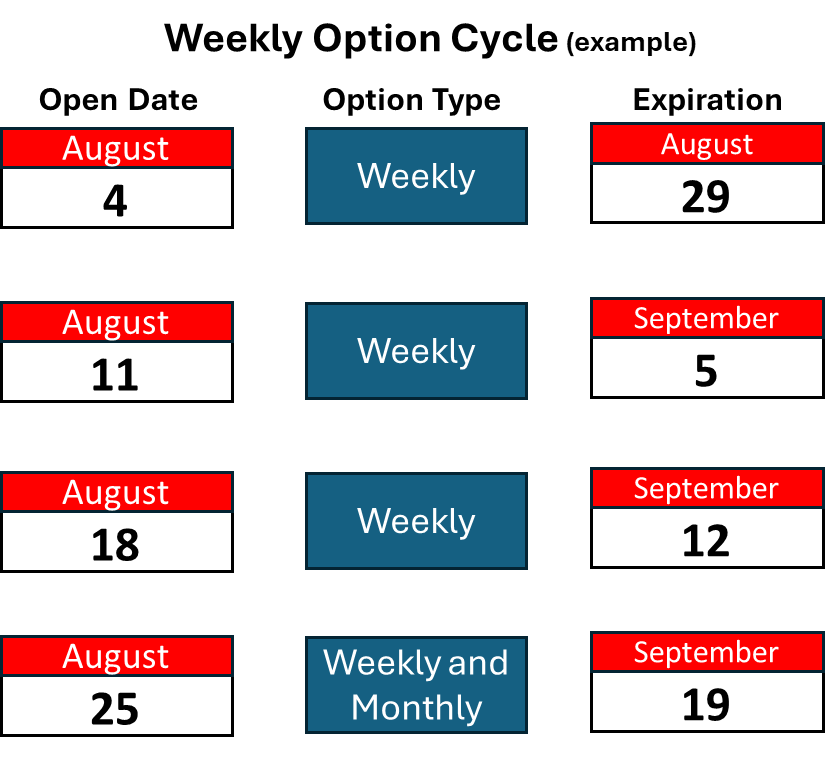

At first glance, holding a monthly option contract for 4 weeks or rolling through weekly options for the same 4-week period may seem like two ways of doing the same thing. In both cases, you’re invested for roughly a month. But the structure of how you enter and manage those positions makes a big difference. By spreading positions across weekly expirations instead of committing all capital to a single monthly cycle, investors unlock important advantages in risk management, cash flow, and performance consistency. Here is an example of the weekly expiration scheduled that is covered in the Bull Strangle Newsletter:

The following are six key reasons why the weekly cycle provides a superior framework:

1. Reduced Timing Risk

When trading monthly options, you commit your capital all at once. If your entry point happens to coincide with a market high, you carry that unfavorable entry for the entire 4 weeks. Weekly options reduce this timing risk by staggering entries. Instead of going all-in on day one, you enter roughly one-quarter of your capital each week. This dollar-cost-averaging approach smooths entry points across different market conditions, reducing the chance that a single bad entry dominates results.

2. Flexibility to Adapt to Market Conditions

Markets are dynamic. Volatility shifts, earnings reports drop, and economic news moves prices within days—not weeks. Monthly options leave you locked into a contract that may no longer align with the current environment. With weeklies, you can adjust every Friday:

- Shift strikes closer or farther depending on implied volatility.

- Target or avoid upcoming events like earnings.

- Rebalance exposure if your market outlook changes.

This shorter feedback loop means you’re constantly realigning with real-time market conditions.

3. Lower Emotional Pressure

Deploying all capital into a single monthly option creates a psychological all-or-nothing scenario. If you’re right, you feel brilliant. If you’re wrong, it can feel like the entire month is wasted. Weekly expirations reduce this emotional burden. By spreading trades out, your results are averaged across four different outcomes, making it less stressful if one week underperforms. This not only improves discipline but also reduces the temptation to overreact or abandon a strategy prematurely.

4. Improved Cash Flow Management

Monthly options tie up capital until expiration. That means you wait 4 full weeks before trades settle and cash becomes available again. Weekly expirations, by contrast, generate rolling cash flow. Each week, a group of trades expires and capital is freed for reinvestment or reallocation. This cadence creates more consistent cash management and allows for faster compounding if profits are redeployed promptly.

5. Better Risk Control and Position Sizing

Managing risk is easier when exposure is built gradually. With weekly expirations:

- You can scale into trades over four weeks rather than committing upfront.

- If volatility spikes or conditions change, you can slow or pause new entries.

- Position sizing is more precise because you’re adjusting weekly instead of once a month.

Monthly expirations force a single decision point, making it harder to adapt or rebalance risk mid-cycle.

6. Performance Diversification

Markets can behave very differently from week to week. One week may bring a Fed announcement, another a major tech earnings report, and another relatively quiet trading. By entering four staggered weekly trades over the same 4-week horizon, your portfolio is exposed to a variety of conditions. This performance diversification smooths results over time, reducing reliance on one set of circumstances. A monthly option, on the other hand, is tied to the conditions that existed at the moment of entry—leaving performance more dependent on being “right” at that single point in time.

The Bottom Line

Trading weekly options over a 4-week horizon provides significant advantages compared to a single monthly cycle of the same duration. By staggering entries, adapting to evolving conditions, reducing emotional stress, improving cash flow, controlling risk, and diversifying performance, weekly expirations offer a more resilient and flexible approach to generating consistent returns. At the Bull Strangle Newsletter, we view weekly cycles as more than a tactical tool—they’re a structural advantage that investors can leverage to manage risk and enhance

More Information

For a short video explaining the Bull Strangle strategy.

For more detail on the strategy

For performance summary of last weeks trades

To subscribe to the Bull Strangle Newsletter

Contact

Darren Carlat

Managing Director

Darren@SpreadEdgeCapital.com

(214) 636-3133

Disclaimer

This information is for informational purposes only and should not be considered as investment advice. Past performance is not indicative of future results, and all investments carry inherent risk. Consult with a financial advisor before making any investment decisions.